Hong Kong’s maritime industry extends significantly beyond the purely physical movement of cargo at ports. Steeped in a rich history of international trade, it is home to a vibrant community of shipowners, shipmanagers and number of other maritime service providers along the value chain. Hong Kong’s International Maritime Centre (IMC) is also a major contributor to direct economic output as well as to other sectors of the economy – particularly import/export, wholesale and retail trades.

But, as we have witnessed, neighbouring cities have made substantial developments in their maritime hubs and this has and continues to pose a threat to Hong Kong’s vital IMC. Most notably, Singapore and Shanghai have enhanced their service offer and have been very aggressive in contesting for and attracting maritime companies throughout the past decade.

To compete and expand its IMC, Hong Kong needs to take wise decisions and appropriate actions which focus on both supply and demand. A critical mass of commercial principals (such as shipowners, ship management companies etc.) must be sustained in order to generate sufficient demand for services, while comprehensive support must be available to supply their needs.

But – how do we get there?

BMT recently completed a study on behalf of the Hong Kong Transport and Housing Bureau (HKTHB), which – combining rigorous analysis with stakeholder participation – set to define achievable objectives for enhancing Hong Kong’s IMC. A well-planned development roadmap would enable Hong Kong to retain a sizable maritime service cluster, and remain the place from which maritime services are sought by the local and international shipping industry.

Careful attention has been paid to understanding the constraints and opportunities facing Hong Kong, both from industry and government perspectives. In particular, implementation issues have received careful attention during the formulation of recommendations.

Let’s look at the broad strokes of this study through a series of diagrams and charts:

Methodology

Benchmarking

Current Position vs Where we want to be (and can be, realistically)

Opportunities & Threats….

Hong Kong's “contestable” maritime cluster and service areas are weakening. If no action is taken, there will be a negative impact on Hong Kong's strengths and competitiveness…

Creating the Strategy: Structured approach, clearly defined goals

Revisiting the Target Scenario

- Local: many commercial principals - ship managers, owners, operators and traders; enhance high value-added services - ship finance, insurance, law and arbitration.

- Regional / National: the preferred location of global (and in particular Mainland) commercial principals sourcing intermediary services.

- Global: differentiate as ‘springboard’ that facilitates Mainland shipping companies to operate internationally, and foreign companies to expand into the Mainland market.

A Roadmap to get there

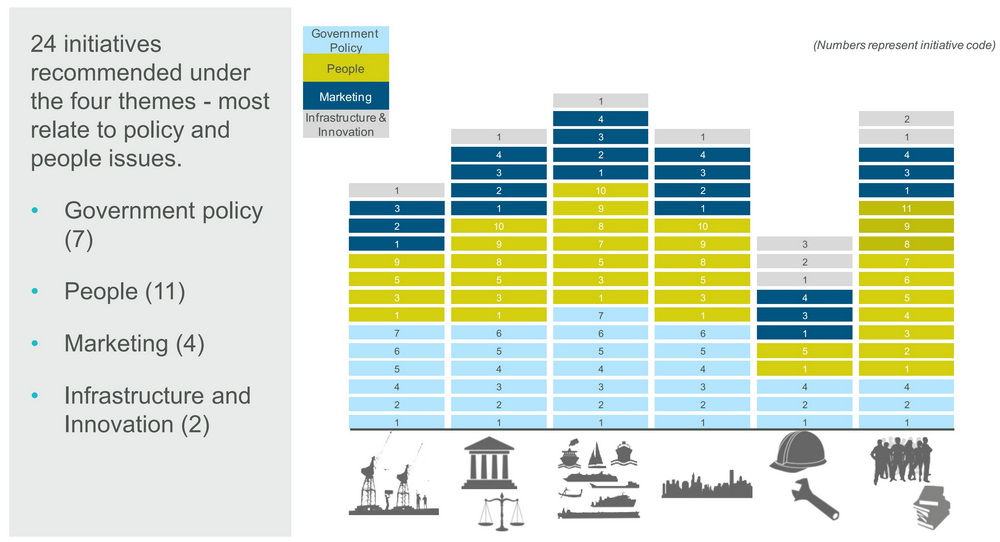

BMT put forth a total of 24 recommended initiatives under 4 themes; relating to policy and people issues. Read more on the recommendations on this link.

Author: Richard Colwill - BMT Asia Pacific / Publisher: SCMO